Create an Aster account for alerts on homes right for you. You can update and adjust your alerts and ‘favourites’ through your own account as you go and you’ll be the first to get information on homes when they become available.

It’s an ownership thing.

.jpg)

Aster’s new build shared ownership application and assessment process

General info

- First come, first served: Aster’s shared ownership homes are usually offered in the order applications are received. Details on our first come, first served policy can be found here.

- Exceptions: Some developments or properties may have a different application policy, but don’t worry, this will be clearly explained when you apply.

- Minimum surplus income: Aster’s minimum surplus income policy can be found here.

- Adverse credit: Aster’s adverse credit policy can be found here.

How to apply

Step 1: Register your interest.

- Contact the Aster sales team once you’ve seen a home you’d like to apply for.

- Aster will send you:

- Pricing information, floor plans, site plans.

- Information on the homes available.

- Any local connection requirements that apply to the homes.

Step 2: Apply for a home and carry out a stage 1 affordability assessment.

- Complete an initial affordability assessment with TMP Mortgages, Aster’s appointed partner.

Step 3: Aster application form

- Fill out Aster’s online application form. This can be found here.

Step 4: Property allocation and stage 2 affordability assessment.

- If you pass the stage 1 affordability assessment, you’ll be allocated a shared ownership home.

- You can now complete the stage 2 affordability assessment with TMP to determine the share you can buy.

- You’ll need to provide TMP with the following documents listed in their guide here.

- Note: TMP’s affordability assessment is not mortgage advice and the assessment does not guarantee the availability of a mortgage.

Step 5: Ask questions and read the Key Information Documents (KIDs)

- Ask the Aster sales team any questions you have about the property/development and the process.

- Read the “Key Information About the Home” document that is available alongside the property details on Aster’s website.

Step 6: Final confirmation and reservation

- If you pass the Stage 2 affordability assessment, Aster will:

- Confirm the share you can buy.

- Explain the next steps in your home buying journey.

- Send you the “Key Information Documents” to read through.

- Once you’ve read everything and are happy with the home you’ve chosen, you can pay your £250 reservation fee and complete our reservation form to secure your home.

Important notes

- Aster can refuse applications if:

- You don’t meet the eligibility or affordability criteria.

- You can’t or won’t provide the required documentation requested.

- You want to buy a different share amount than that which you’ve been approved for (either higher or lower). However, if reasonable rationale has been provided, then we may consider agreeing the sale at an alternative share amount.

Need help or have any questions?

Contact the Aster sales team:

Phone: 01380 735480

Email: homeownership@aster.co.uk

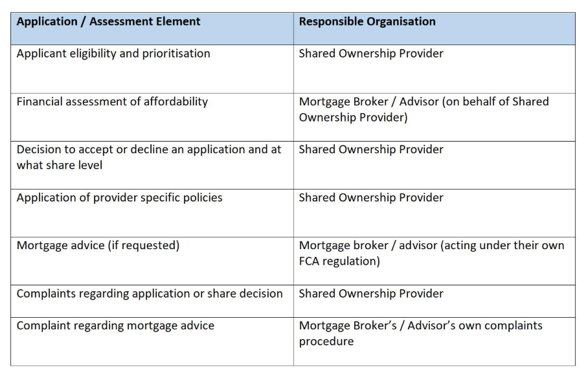

NB. A summary of the application process and who the responsible organisation is, is summarised in the below table: