Create an Aster account for alerts on homes right for you. You can update and adjust your alerts and ‘favourites’ through your own account as you go and you’ll be the first to get information on homes when they become available.

It’s an ownership thing.

Getting a shared ownership house survey

When it comes to buying a home, you’ll have heard people discussing the need for a ‘house survey,’ and you may be wondering what that is and how to go about getting one. Well, no need to worry we’re going to break it down so it’s really simple.

You may not always need a survey – and if that is the case you don’t want to be forking out for one unnecessarily. If you do decide to have a survey conducted, you want to be sure you are getting your money’s worth.

When it comes to shared ownership, you don’t necessarily need a survey when you first make your purchase – another way we can make your house buying experience that little bit easier.

What is a house survey?

A property survey is a detailed report and inspection of the condition of a property. A surveyor inspects the house to tell you if there are any issues such as structural problems as well as other issues. They will highlight major repairs and work that may need to be done and provide a report that has commentary on the entire property.

Types of house surveys

There are different types of homebuyer surveys and the survey you chose should be based on the condition of the property you are buying – not the cost.

RICS Home Survey Level 1 – This type of survey is most suitable for a conventional house, flat or bungalow in good condition. It is a basic survey that covers the condition of the property, any risks and potential legal issues as well urgent defects. There is no valuation with the Level 1 survey.

RICS Home Survey Level 2 – These surveys cover structural problems, such as damp and any other hidden issues. They don’t look beyond walls and floors. These surveys are suitable for existing properties which don’t have obvious concerns. You can choose whether or not to include a valuation which can help you negotiate the house price if needed.

RICS Home Survey Level 3 – This is the most comprehensive survey and is suitable for any property but is most common for large or old properties and if you are planning major work. These surveys are very extensive and detail repairs needed – but don’t provide valuation. The RICS Survey presents the findings in a clear presentation style.

Mortgage valuation survey

A mortgage valuation is not the same as a survey. It is required by your mortgage lender to determine how much a property is worth. Your lender will insist on instructing their own valuer but you will pay for it – usually around £350. Where surveys are optional, mortgage valuations are not.

What type of survey do I need?

The survey you choose will depend on your property and your requirements. As discussed above, each survey covers different things and are more suited to certain properties.

The difference between a homebuyer report and building survey

A homebuyer report is generally suitable for homes that don’t require much work and appear to be in reasonable condition – the report will cover things such as structural concerns like damp and any other hidden issues, they sometimes include a valuation. A building survey or RICS Level 3 is more suitable for old properties or if you plan to do a lot of work – these are the most in-depth survey and will detail advice on repairs as well as a full structural survey.

Do I need a survey when buying a house?

The short answer here is no. A survey is completely optional, but if you are getting a mortgage a valuation is not. A survey can help you identify faults and repairs but if the house you are buying is in excellent condition you may want to skip the survey.

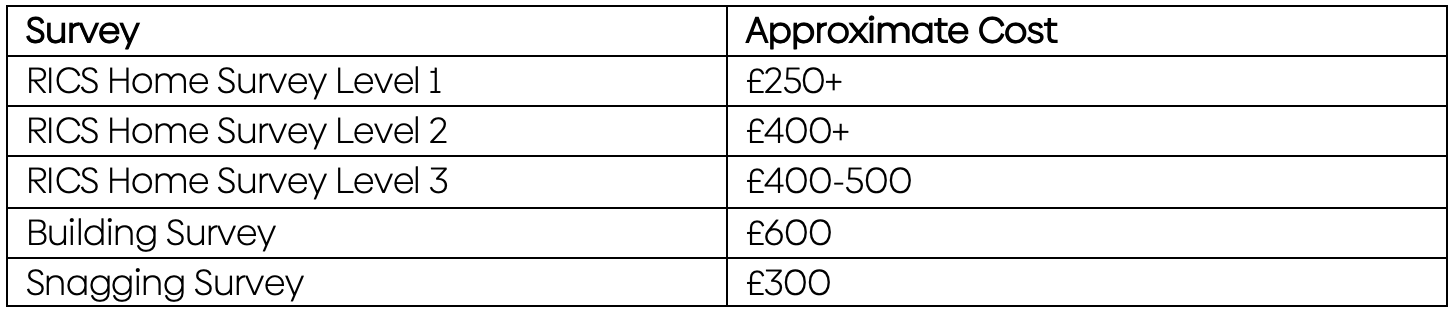

How much for a house survey?

Each survey will vary in cost but here is a guide to help:

How long does a survey take?

The length of the survey will depend entirely on the property itself – the number of repairs, the type of survey needed, the age of the house and the size of the house. It can be quite a hefty job walking around the bigger houses. Generally, it can range from as little as 90 minutes right up to 6 hours or more.

What does it cover?

This will depend on the type of survey you choose – but the general purpose of a house survey is to identify faults. The specific type of faults and subsequent advice will differ based on the type of survey. The most comprehensive survey is the building survey.

Who arranges the survey when you buy a house?

The responsibility of arranging a survey is yours as the buyer – this is because they are optional.

New-build surveys

Surveys are still advised with new-builds and are called a ‘snagging’ survey – the purpose is to spot any minor issues such as door misalignment as well as major structural issues. They generally cost upwards of £300 but are advised in order to ensure you can get any issues repaired as soon as possible.

What is snagging?

Snagging is a slang term used in construction to define inspecting builds for minor defects which need rectifying – this is the same process as a new-build survey.

The Aster process

At Aster we believe buying a home should be affordable and available – which we do through shared ownership. Many of the processes remain the same as buying on the open market – but with much less of the hassle. If you want to find out more about shared ownership with Aster you can contact our friendly sales team or browse our latest developments.